Getting to Grips with Your Credit Score

If you’re not sure about what your credit score is and the impact that it can have on your life it is important that you begin to do so. Having a solid understanding and grasp of your credit score could make a massive difference to how you manage your finances in the future. Your credit file is a collection of data and information relating to your financial transactions throughout your entire life.

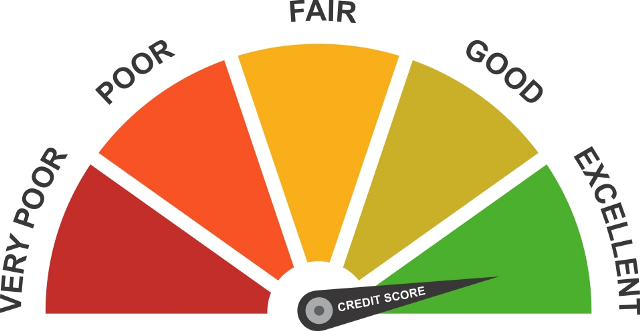

There are a number of credit agencies, including Experian, Equifax, and TransUnion. Each agency has a different way of collecting and scoring data, painting a picture of how you as an individual react to debt and how you manage your finances. If you miss a payment on your credit card, it will place a black mark against your name on your credit file. If you maintain payments and never miss a payment on a personal loan, you’ll build a good credit score.

This is all-important as it helps to build an accurate picture of you as a financial entity when potential lenders are looking at your application for credit. If you are trying to get a new credit card, take out a loan, purchase a car, or acquire a mortgage, the lender will look at your credit file. It is important that you understand this, as your actions now will have an impact on your ability to acquire credit in a year or so. Every action matters. It is easy to decimate your credit score with reckless behaviour, high spending, and failing to make agreed payments on credit lines you have already taken out. Alternatively, it is easy to build a healthy credit score that shows your actions are positive. It’s a habit either way, and knowing your credit score can help you manage which way you turn.

In almost every area of your life your credit score is important, but it is also worth pointing out that the modern era of credit has changed a little bit. Say for instance, that you have come into a short-term financial predicament (your car may have broken down and you are 10 days away from payday by your employers). If you have poor credit but have been steadily building up a good credit score, should you be prevented from taking out a loan?

A new breed of responsible and reputable payday loan lenders would disagree. These companies can provide you with a short-term, small loan, even if you have poor credit. Adverse credit loans can be of great importance to those in this predicament. As long as you can demonstrate that you have been building a good credit score in recent times, that you are in full time employment, a steady income, and a bank account, you can receive a fast cash loan within a few hours of the application process being completed on a payday loan website. This goes to show how important your credit score is, as even if it is still technically poor, this approach shows which direction you are headed in.