Why Personal Loan Apps Make It So Easy To Get A Loan Fast

Simple, immediate, paperless, and flexible are not just catchphrases; they are features people look for when using most services, including personal loans. A few years ago, applying for a personal loan was time-consuming. In addition, people found the compliance process cumbersome and rather complex, requiring significant paperwork. Today, your mobile phone is all you need to look at if you need a fast loan. So forget about going to the banks anymore for the sake of short-term personal loans.

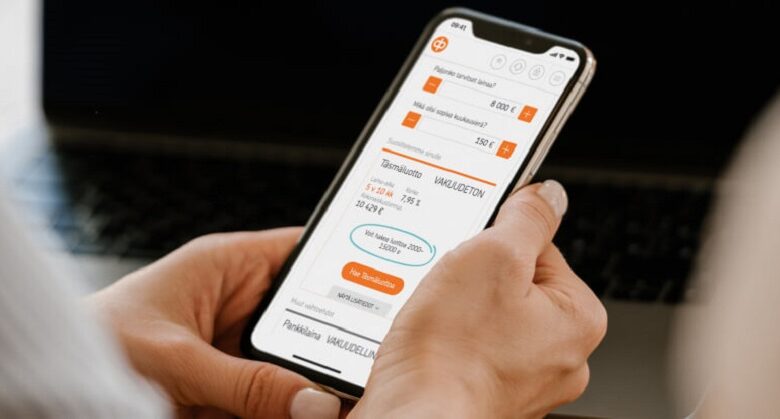

Online instant loans apps are preferred over more conventional loan application processes by millennials and young borrowers who are up to date on new technological developments. Instant approval and speedy digital personal loan applications increase the viability of these online platforms.

Ease of paperwork: The urgent loan app has an intuitive user interface that makes it simple to upload all necessary paperwork and borrower information. You don’t need to carry the originals around, lowering the risk of loss or damage and removing the hassle of making photocopies. The entire application process is done online, from filling out the application to uploading the documents. Additionally, online loan providers only request the most basic information and records, such as identification, address, and income documentation.

Save time and energy: You can access amazing financial services whenever needed on the personal loan app online. You can easily apply for a personal loan while traveling, at home, or at work. The long lines are a thing of the past when applying for a loan at a financial institution. You can now apply for it without going in person to the branch. The process has become paperless by enabling the e-KYC feature on a personal loan application, saving you time and effort.

No need for collateral: You don’t need to put up any collateral to get a personal loan because they are unsecured. This is why obtaining personal loans is simpler than obtaining loans for homes, cars, and other types of financing. However, as a borrower, you should know that lenders take on more risk when making unsecured loans, which is why the interest rates are typically higher.

Use it for anything: Personal loans online can be obtained for various individual needs, including sudden financial straits such as increasing your monthly budget or covering unexpected expenses such as urgent travel or children’s higher education. Any of these situations can be helped by a personal loan because it gives you access to quick money. And the best part is that an Indian loan app won’t even ask why.

Comparison: When applying for a conventional loan, it can be challenging to track various financial institutions’ advantages. However, suppose you apply for a personal loan online through an instant indian loan app. In that case, it’s simple to compare interest rates, processing costs, loan terms, and eligibility requirements online and find the lender with the best conditions for your needs. You have loads of options to select from.